The Bratislava office market closed 2025 on an exceptionally high note, reporting record-breaking leasing activity and significant shifts in market dynamics. New, more accurate methodologies for data tracking provide a clearer picture than ever before, revealing a vibrant and competitive environment for businesses seeking office space.

Unprecedented Leasing Activity Defines 2025

The year 2025 proved to be a landmark year for the Bratislava office market, with a staggering 271,000 m² of office space leased. This represents a remarkable 35% year-on-year increase, signaling robust demand. The fourth quarter alone was particularly strong, accounting for 146,000 m² of this total, underscoring the market's momentum as the year concluded.

Understanding the Modern Bratislava Office Landscape

Significant methodological changes introduced in 2025 have refined how the Bratislava market measures its inventory, aiming for enhanced accuracy. The total commercial office space, excluding owner-occupied buildings, now stands at 1.75 million m². This diverse portfolio comprises 22% A+ standard offices, 38% Class A, and 40% Class B spaces, offering a range of options to suit various business needs and budgets. The market also saw new additions, such as the Zváračák project, which contributed an additional 4,000 m² of B-category space.

Driving Demand and Key Transaction Trends

The robust leasing activity was primarily driven by the financial sector, which accounted for 23% of transactions, closely followed by the public sector at 19%. While renegotiations constituted the largest share of activity (70%), new leases (16%), pre-leases (12%), and expansions (3%) also played significant roles, demonstrating a healthy mix of market engagement. It's worth noting that the majority of these transactions, 41% to be precise, occurred within highly sought-after Class A buildings, indicating a preference for premium office environments.

Sustainability Takes Center Stage: Green Office Space in Bratislava

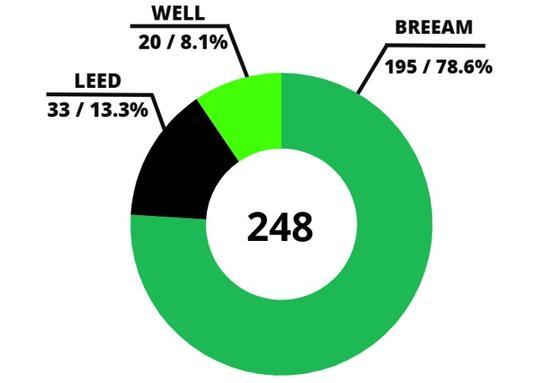

The definition of 'green buildings' in Bratislava has evolved, now strictly including only properties with operational sustainability certifications. Under this new criterion, 691,000 m² of office space, representing 40% of the total market, is officially certified as green. Furthermore, an additional 200,000 m² is currently undergoing the certification process, highlighting a growing commitment to environmentally responsible office solutions within the city.

Market Dynamics: Vacancy Rates and Prime Rents

The new methodology also provides a clearer picture of market availability. The overall vacancy rate in Bratislava currently stands at 14.09%. This marks the lowest level recorded since early 2023, reflecting the tightening market conditions driven by strong demand. Correspondingly, prime rent has seen an increase, reaching 21.00 EUR/m²/month, with further upward adjustments anticipated for 2026. This trend signals a healthy market but also indicates a potentially more competitive environment for securing prime office locations.

Source: kancelarie.sk