Investments will revive, volumes will grow

High interest rates slowed down investment activity in the first half of 2024. The total investment volume in Slovakia reached 537 million euros, which was a decrease of 19 percent compared to 2023. “In 2024, we recorded investments of more than 537 million euros in 24 transactions, with six cases involving portfolio sales. Compared to the previous year, this represents a decrease in investment volume of 19 percent,” explains CBRE Slovakia Sales Director Ľubor Procházka.

Industrial and logistics properties performed the most, accounting for half of total investments. The retail sector accounted for 23 percent, while office properties fell to 18 percent. The remaining 9 percent was divided between residential, healthcare and mixed projects.

However, analysts expect investment activity to increase this year. “Based on the ongoing transactions, we expect the investment volume to reach EUR 750 million in 2025,” adds Ľ. Procházka.

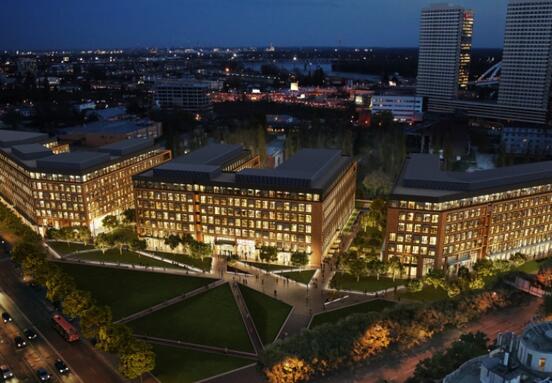

Offices with record rental growth

Demand for office space increased for the second year in a row, while new construction remained at a historically low level. In 2024, only seven thousand square meters of new leasable space was added, which is significantly less compared to 2023.

“Limited new supply and relatively high demand contributed to a significant decrease in the vacancy rate, which fell to 12.57 percent at the end of 2024 from 14.20 percent at the end of 2023. This is one of the most significant year-on-year decreases ever,” said Oliver Galata, Head of Office Leasing at CBRE Slovakia.

Premium rents rose by eight percent to a record 19.5 euros per square meter per month. Growth is expected to continue in 2025, albeit at a slower pace. In 2026, the market could see some easing of rent pressure as 40,000 square meters of new office space is added. The average annual increase until 2029 should be around 35,000 square meters.

Although the office market faced stagnation, investors still showed interest in premium office buildings, which maintained stable values. “This is especially true in terms of transaction volume and investor interest in the segment. However, when it comes to comparing the so-called Prime yield, the expected profitability of a building in a given segment in a top location, in top condition and with top tenants, the comparison of office buildings and industrial properties is very similar,” explains Tomáš Cár, Real Estate Transaction Manager at 365.invest.

The logistics sector is stabilizing

Although logistics dominated investments, demand for space in this sector fell by 41 percent year-on-year. The vacancy rate of industrial and logistics spaces exceeded five percent for the first time since 2021.

“The modern industrial and logistics supply in Slovakia expanded to 4.5 million square meters, which represents a year-on-year increase of 13 percent. The Western Slovakia submarket led the new supply with the delivery of almost 104 thousand square meters,” says Michal Cerulík, Director of the Industrial and Logistics Lease Department at CBRE Slovakia.

He expects demand to stabilize in 2025, with rents remaining at current levels. However, in areas with high demand, a slight increase in rental prices may continue.

The sector also faced challenges

An important factor for the logistics park sector was the growth of the Slovak economy, which is linked to the automotive industry and exports to Germany. However, forecasts indicated a weakening of demand from suppliers in this segment. “Since the Slovak economy is very open and linked mainly to the automotive industry and exports to Germany, it is important to monitor trends in the automotive sector, as well as the condition of the German economy,” emphasizes T. Cár.

However, Slovakia benefits from a strategic location within Europe, which increases its attractiveness for the 3PL sector, e-commerce, food and clothing industries. Diversification of tenants is therefore becoming an essential strategy for investors.

In 2024, the vacancy rate of industrial and logistics properties increased slightly, which brought more room for negotiating rental terms. At the end of the year, it reached a level of five point eighteen hundredths of a percent, while in 2023 it was at a record low of two point sixty-four hundredths of a percent. “It must be said that the previous record levels reflected an overheated market, where the demand of new tenants was not enough to be covered by new premises, which logically led to a strong growth in rents.”

T. Cár assumes that the slight increase in vacancy will continue in 2025, mainly due to the construction of new halls that do not yet have fully contracted tenants. However, this trend is significantly regional - some locations, such as Trenčín, Bernolákovo or eastern Slovakia, are still experiencing an acute shortage of warehouse space.

The industrial and logistics real estate sector is expected to remain in