Slovakia's Real Estate Funds Hit Record Highs

Slovakia's real estate investment landscape is experiencing an unparalleled surge, with the total value of assets in real estate funds surpassing a record three billion euros for the first time. This significant milestone, reported by the National Bank of Slovakia (NBS) for the second quarter of 2025, underscores a dramatic shift in domestic investor behaviour. Real estate funds now account for over a quarter of the total €11.89 billion invested in all fund types, marking a historical peak and reflecting profound confidence in property as an asset class.

This mass migration of capital from traditional savings accounts to real estate funds is driven by a quest for stability and protection against inflation, which has increasingly eroded the value of passive savings. As experts warn that passive saving is no longer sufficient, Slovaks are actively seeking more intelligent ways to grow their wealth, and real estate funds offer an accessible and understandable avenue to participate in the real estate market’s growth.

Understanding the Investment Drivers

Several factors fuel this investment boom. Firstly, the deeply rooted historical trust in real estate among Slovaks provides a sense of security. Secondly, the persistent threat of inflation acts as a „financial educator,“ compelling individuals to find safe havens for their money. Bank accounts, often yielding negative real returns, have pushed investors towards alternatives that offer better protection and growth potential.

Furthermore, real estate funds democratize property investment. They allow participation even for those without the hundreds of thousands needed to buy an investment apartment, making the market accessible to a broader public. This shift also reflects a growing financial literacy, with investors realizing that active capital allocation is crucial for long-term financial health.

A Strong Focus on Commercial and Logistics Properties

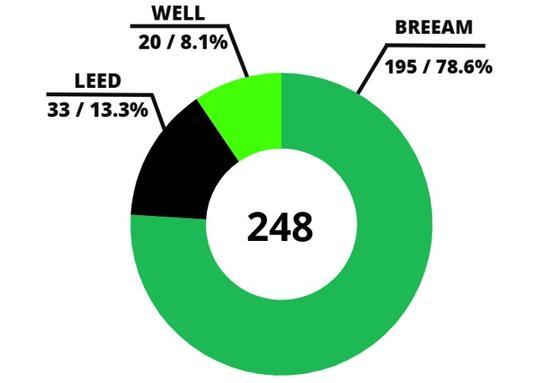

For businesses seeking rental space, the composition of these investments is particularly encouraging. Statistics reveal that the most sought-after funds are those concentrated on commercial properties, logistics, and modern residential projects. These segments are favored for their stable cash flow and attractive long-term returns, which are critical for investors navigating uncertain economic times.

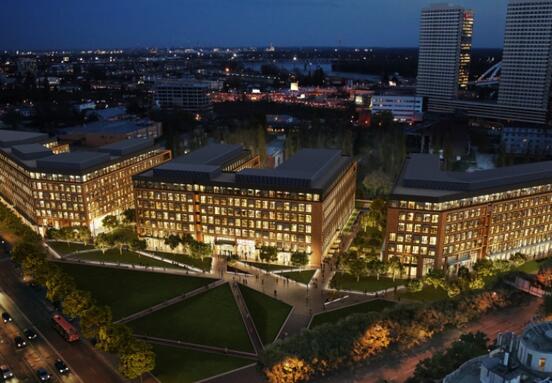

The emphasis on commercial and logistics real estate directly translates into a healthier, more dynamic rental market. As capital flows into these areas, it fuels the development of new, high-quality, and professionally managed office spaces and logistics parks across Slovakia. This sustained investment creates an environment where businesses can find modern, efficient, and well-located premises to support their operations and growth.

Benefits for Businesses Seeking Rental Space

The burgeoning real estate fund market offers tangible advantages for companies scouting for office or warehouse rentals:

- Modern, High-Quality Inventory: Investment in new projects ensures a continuous supply of state-of-the-art facilities designed to meet contemporary business needs, including sustainability and technological integration.

- Reliable & Professional Management: Properties managed by investment funds often adhere to higher standards of maintenance and service, ensuring a stable and professional environment for tenants.

- Sustainability Focus: A growing trend towards ecologically certified and energy-efficient buildings enhances the attractiveness of these assets, aligning with businesses’ increasing commitment to ESG criteria.

- Diverse Location Options: From prime urban office districts to strategic logistics hubs, the robust investment landscape provides a wide array of choices to suit various business requirements.

A Dynamic and Forward-Looking Market

Analysts predict this upward trend in real estate fund investments will continue through 2026 and 2027, driven by market stability and ongoing inflationary pressures. This sustained confidence further solidifies Slovakia's position as a stable and attractive investment environment within Central Europe.

Technological advancements and the digitalization of funds are also playing a pivotal role, enabling faster access to information and more efficient portfolio management. New platforms and digital tools are making it easier for a wider group of investors, including younger demographics and potentially foreign capital, to engage with the Slovak real estate market.

Conclusion: Your Business Advantage in Slovakia

The record-breaking investments in Slovak real estate funds paint a clear picture of a confident and expanding market. For businesses looking to rent office or warehouse space, this translates into an ecosystem ripe with opportunities: access to modern, high-quality properties, professionally managed assets, and a market poised for continued growth. As Slovakia's real estate sector matures, it increasingly offers a stable and promising environment for companies to establish or expand their operations.

Source: trend.sk