The first half of 2025 has seen an unprecedented revitalization in the Central and Eastern European (CEE) commercial real estate market. Total investment volumes across five key CEE markets soared to nearly €5 billion, signaling a strong rebound and renewed investor confidence. This remarkable activity, representing almost 60% of the entire 2024 total, underscores a dynamic and attractive environment for businesses looking to secure prime office or warehouse facilities.

CEE Investment Hotspots: Your Next Strategic Location

The CEE region is proving to be a magnet for investment, with specific countries emerging as leaders. The Czech Republic spearheaded investment activity, attracting a staggering €2.1 billion, showcasing its appeal as a robust hub for commercial ventures. Poland followed closely with €1.7 billion, and together, these two nations accounted for a dominant 77% of regional investment. This concentration of capital indicates well-established and growing commercial ecosystems, ideal for businesses seeking stability and growth potential.

Beyond these leaders, Romania is experiencing a dynamic period, particularly with its office sector making a "remarkable comeback," capturing nearly one-third of the country's total investments. This highlights Romania as an increasingly viable option for companies in need of modern office solutions. While not leading in investment volume, countries like Hungary are also seeing significant domestic investor activity, indicating a strong internal market for commercial property.

Sector Spotlight: Unparalleled Opportunities in Logistics and Offices

For businesses seeking efficient supply chain solutions, the logistics sector remains a standout performer. It attracted an impressive 32% of total investment, particularly in the Czech Republic, Poland, and Slovakia. This sustained interest in warehouse and logistics facilities translates into a healthy pipeline of modern, well-located industrial spaces available for rent, perfect for e-commerce, manufacturing, and distribution operations.

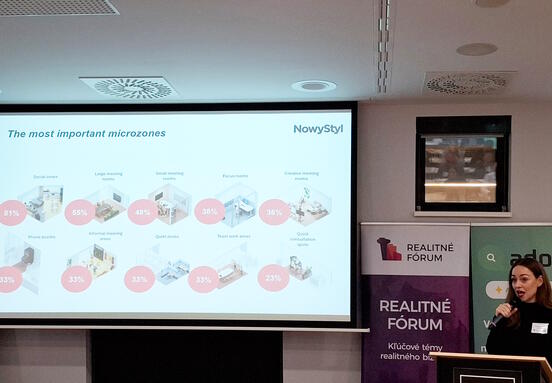

Meanwhile, the office sector is firmly back in the spotlight, accounting for 23% of the total investment volume. This resurgence, especially noted in Romania, signals a renewed demand for high-quality office environments as companies re-evaluate their workspace strategies. Businesses looking for premium office space in thriving urban centers will find a competitive and evolving market in CEE.

Driving Forces: Investor Confidence and Market Stability

The robust investment figures are a clear indicator of strong market confidence. Both domestic and international players are actively deploying capital, which translates into more development and higher quality commercial properties becoming available. Notably, domestic investors are playing a growing role, accounting for 78% in the Czech Republic, 80% in Hungary, and 35% in Romania. In Poland, there's a welcome return of major institutional investors, particularly in the lucrative warehouse sector, alongside increasing domestic capital.

Major transactions like Blackstone’s €470 million acquisition of the Contera portfolio and a €253 million sale-and-leaseback of Eko-Okna’s manufacturing facilities further underscore the deep liquidity and attractiveness of the CEE market for significant commercial property deals.

Positive Outlook: The Ideal Time to Secure Your CEE Commercial Space

The forecast for H2 2025 remains exceptionally positive. A robust transaction pipeline, stable prime yields, and declining interest rates are all contributing factors that will continue to fuel market activity. For businesses, this means a favorable environment to lease or rent commercial property. Whether you are expanding your distribution network with a new warehouse or establishing a regional headquarters with modern office space, the CEE market offers diverse and promising opportunities.

Now is an opportune moment for businesses to explore the dynamic commercial real estate landscape across Central and Eastern Europe. The strong investment volumes and positive market indicators point towards a period of sustained growth and availability of high-quality premises to support your operational needs.

Source: property-forum.eu