Understanding the New Bratislava Office Market Data

The Bratislava office market has adopted a new methodology as of Q1 2025 for calculating its total supply. This crucial change provides a more accurate and transparent view for businesses, excluding 'owner-occupied' buildings that are not available for rent. The adjusted office fund now stands at 1.76 million square meters, a revised figure that better reflects truly available commercial space. This shift aims to provide clearer insights into market opportunities and real vacancy levels.

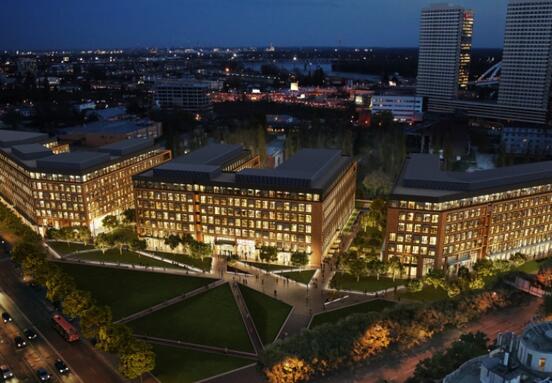

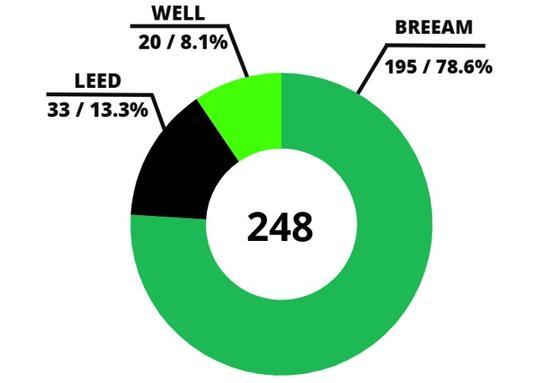

Quality and Sustainability: The Driving Forces

Quality is paramount in today's Bratislava office market. The revised portfolio shows a stable distribution across quality classes: 22% are Class A+, 39% Class A, and 39% Class B. What's more, nearly half (48%) of the total commercial office supply – amounting to 851,720 square meters across 45 buildings – is environmentally certified. This strong presence of green buildings, with certifications like BREEAM, LEED, and even WELL GOLD, underscores a market increasingly prioritizing sustainability. Businesses seeking modern, efficient, and eco-friendly premises will find ample high-standard options, including top-tier projects like Twin City Tower, Pribinova 40, Pradiareň 1900 (BREEAM Outstanding) and Einpark Offices (LEED Platinum, LEED Zero Carbon).

Latest Leasing Activity and Sector Trends

The third quarter of 2025 saw 24,835 square meters of office space transacted. While this represents a quarterly and yearly decrease, the market activity highlights key trends. Renegotiations accounted for a substantial 49% of transactions, closely followed by new leases at 48%. The Information Technology (IT) sector remains a dominant force, leading demand with 5,388 square meters leased, followed by professional services and financial institutions. A notable eight transactions exceeded 1,000 square meters, emphasizing the continued presence of large tenants. A significant 63% of all leases occurred in Class A buildings, reinforcing the strong demand for high-quality, technically advanced spaces.

Navigating Vacancy Rates in a Transparent Market

With the new data methodology, the overall vacancy rate for commercially available office space in Bratislava now stands at 14.47% (on 1.76 million sq m), up from the previously reported 12.65% (on 2.05 million sq m). This adjustment provides a more realistic picture of free capacity, as owner-occupied, fully utilized buildings are no longer skewing the figures. Vacancy rates vary by class: Class A+ boasts the lowest at 8.43%, while Class A stands at 18.64% and Class B at 13.74%. Location also plays a critical role, with City Center and South Bank areas showing the lowest vacancy at around 7%, contrasting sharply with the Outer City's 18.84%.

Future Office Supply: What's on the Horizon?

The pipeline for new office developments remains somewhat limited in the short term. Businesses can expect projects like Zváračák (4,000 sq m) by the end of 2025, followed by Dunaj (6,400 sq m) and Ganz House (9,400 sq m) in 2026. However, a more substantial increase in supply is anticipated in 2027, with major projects like Chalupkova Offices (18,200 sq m), Istropolis Atrium (15,500 sq m), and Nesto (3,500 sq m) scheduled for completion. These future investments are designed to meet the growing demand for efficient, sustainable, and technologically advanced office spaces, continuing to drive differentiation within the market.

Prime Rents Reflect Quality and Scarcity

The prime office rent in Bratislava remains at €20.50 per square meter per month, consistent quarter-over-quarter but marking an 8% increase year-over-year. Experts anticipate a slight rise by the end of the year. This stability, coupled with upward pressure, reflects a tension between high demand for modern, quality spaces and their limited availability. Oliver Galata from CBRE notes that the scarcity of premium office products continues to differentiate rents between top-tier properties and the rest of the market. Businesses are increasingly seeking spaces that boost operational efficiency, leading to strong demand for Class A+ and A buildings, which account for approximately 75% of leased areas. The diverse sectoral demand from IT, professional services, and finance further supports market stability.

Conclusion:

Bratislava's office market is clearly evolving, offering businesses a clearer, more transparent view of available commercial spaces. The emphasis on high quality, environmental certification, and modern amenities is driving tenant decisions and rental dynamics. As new developments gradually come online, the market will continue to adapt to the strategic demands of businesses seeking efficient and sustainable environments.

Source: reality.trend.sk