In terms of ownership structure, as in the previous quarter, approximately 4% of buildings are state-owned and another 11% are buildings that are owned and fully occupied by the same entity. The total stock for commercial use remains at 85% of the total modern office space in Bratislava (1.7 million m2).

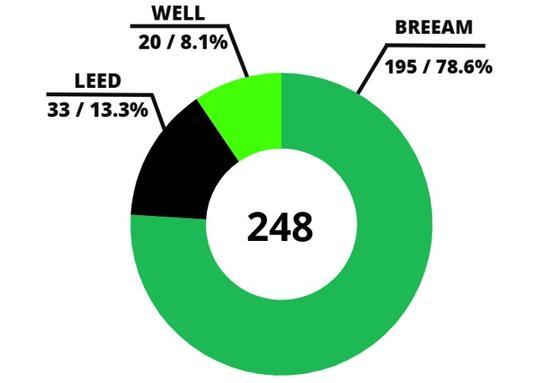

GREEN BUILDINGS

In total, we have almost 827,720 m2 of office space in Bratislava with a valid green/sustainable building certificate. This is 40% of the total volume of office space in Bratislava, or 44 out of 277 buildings. Of the certified offer, 63.6% has BREEAM, 2.3% a combination of BREEAM/WELL GOLD and 34.1% LEED. Only two buildings in Bratislava have the highest BREEAM Outstanding rating - Twin City Tower and Pribinova 40. In the case of LEED Platinum, it is the Ein Park Offices building.

TRANSACTIONS ON THE OFFICE SPACE MARKET (OFFICE TAKE-UP)

Rental transactions reached an area of 39,901 m2 in the third quarter of 2023, which represents a 23% decrease compared to the previous quarter. In a year-on-year comparison, the volume of leased space increased by 2%.

The largest increase was made up of new lease agreements in the volume of 52% and renegotiations in the volume of 37%. Expansions represented 6% and pre-leases were at the level of 5%.

The volume of transactions in the Professional Services sector with an area of 9,159 m2 dominated. The largest transaction carried out was in the Consumer Goods sector, where it was a new lease agreement with a total area of 5,300 m2. A total of 12 transactions with an area of over 1,000 m2 were recorded.

Most of the leased space in this quarter was recorded by the Professional Services sector (22.95%), followed by the Consumer Goods sector (15.18%) and the Pharmaceutical sector (15.15%).

SIGNIFICANT TRANSACTIONS FOR THE 3RD QUARTER OF 2023:

OFFICE VACANCY

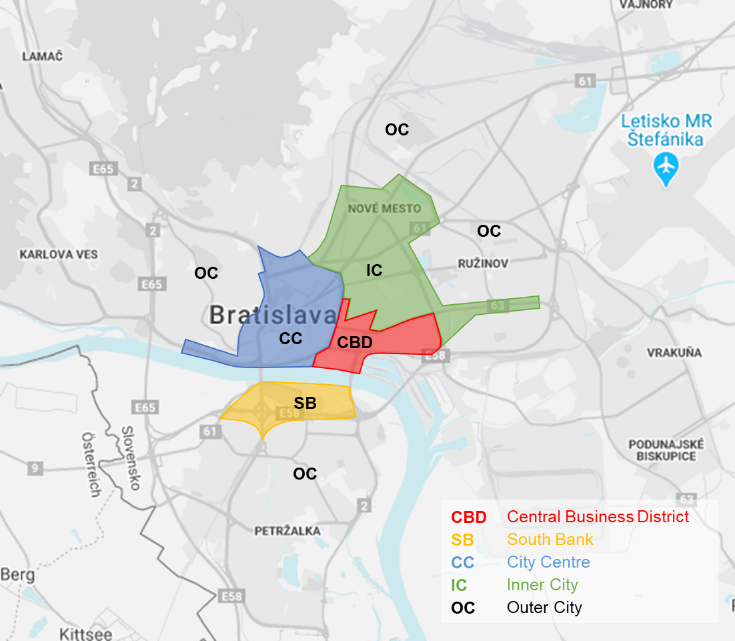

The overall vacancy rate in Bratislava increased to the current 13.80%. The lowest vacancy is recorded in the city center (7.76%), followed by the southern embankment (8.51%) and the inner city (9.94%). The fourth place is the CBD (16.02%) and the last is the outskirts of the city (21.14%).

The increase in vacancy is most significantly caused by the relocation of a large tenant from the outskirts of the city, which caused an increase in vacancy in this district by 5.82%. In the CBD location, vacancy increased slightly due to the completion of two new buildings. On the other hand, it should be noted that the completed Pribinova 40 project, as well as The Mill project, which is currently just before completion, are already almost fully leased.

PRIME RENT

The rent (prime rent) remains at the level of EUR 18.00/m2/month.

For more information, please contact any member of the Bratislava Research Forum. The members of this forum – Cushman & Wakefield, CBRE, Colliers International and iO Partners share non-confidential information in order to provide clients and the public with consistent, correct and transparent data on the office space market in Bratislava.