"From the point of view of commercial real estate, 2023 was very challenging. However, this year we foresee a recovery in some markets in the EMEA region. The market will stabilize and investors focused on the medium term will again be able to more confidently invest their capital in real estate, however, it is necessary to orientate yourself in individual sectors and understand the opportunities for tenants and investors," said the managing director for Central and Eastern Europe of Cushman & Wakefield Jonathan Hallett.

Trends in the office market

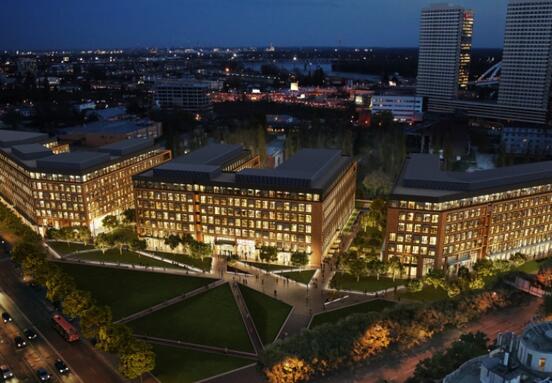

Although the overall demand in the European office market is decreasing, companies are increasingly interested in offices in higher quality premises. According to the real estate consulting company, the emphasis is on high-quality office facilities. Businesses are looking for buildings in a convenient location with excellent amenities and those that meet sustainability criteria.

Similar trends in the office market can also be seen in Slovakia. According to Radovan Mihálek, head of the office real estate team in Slovakia at Cushman & Wakefield, tenants are looking for smaller areas, but with higher quality office space.

"The market is, and will be in short supply in the next few years, especially office spaces of the highest class A+. In the years 2024 and 2025, only a few (negligible in size) administrative buildings of a higher standard will be built, which will only further deepen the gap between demand and supply in the premium segment of office space in Slovakia," explained Mihálek.

Return of demand for logistics real estate

In the field of logistics real estate, demand for these spaces is expected to return after last year's slowdown. "Within the Central and Eastern Europe region, the industrial real estate sector recorded very favorable results, including in Slovakia, where we are registering demand even higher than the levels reached before the pandemic," said Patrik Janšco, head of the industrial real estate team in Slovakia at Cushman & Wakefield.

Demand for residential real estate should remain stable this year. Continued interest in rental housing is expected.